This High-Yield Dividend Stock (8.3%) Has Analysts Saying ‘Strong Buy’ — Should You?

In case you are on the lookout for a wise technique to develop your wealth whereas acquiring a unfavourable earnings, investing in excessive -yielding revenue shares could also be a method value exploring.

These shares present common funds as a result of they usually belong to firms which have robust monetary information and dependable earnings. When the corporate can continuously pay the inventory earnings and keep a wholesome fee fee, it’s normally an indication of stability and adaptability in the long term. This may be translated into an dependable earnings and a set capital of traders.

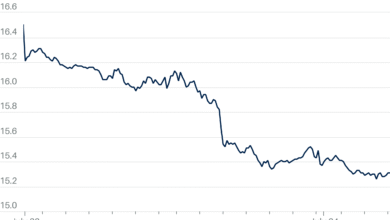

Among the many trusted earnings, ARES CAPITAL (ARCC) seems as a consequence of its excessive return and a powerful date of revenue progress. With a revenue return of about 8.3 %, the specialised financing firm presents a gorgeous earnings stream to those that search to reinforce the money stream of their pockets. Furthermore, the inventory additionally obtained a “robust buy” ranking from analysts, indicating robust confidence in its future efficiency.

Ares Capital is a enterprise growth firm specializing in offering direct loans and particular financing for medium market firms all through america, usually providers by massive conventional banks, creating demand for Ares Capital providers and offering enticing alternatives and earnings in the long term.

Numerous Ares Capital pockets, robust subscription practices, and disciplined threat administration conditions, it’s nicely disciplined to supply robust fundamental earnings to cowl its funds.

For instance, the variety of the Ares Capital pockets, with 566 porcine and common firms which might be uncovered to lower than 0.2 % per funding. This vast diversification helps scale back publicity to any firm or one sector, which boosts the elasticity of the portfolio within the face of market fluctuations. The corporate additionally focuses on lending to the least -oriented periodic firms to providers with strong fundamentals, which helps it to take care of stability even in unconfirmed financial environments. This method continues to assist each earnings and its spectacular document within the revenue funds.

Within the first quarter of 2025, Ares Capital was $ 0.50 per share. It’s value noting that the standard of credit score remained robust, because it holds unwritten loans and excessive threat credit at low ranges traditionally. The corporate additionally maintained a powerful funding momentum, reaching $ 3.5 billion in complete obligations throughout this quarter.

2025-07-21 23:30:00