Bad News Keeps Rolling in for Tesla

-

Tesla produced billions of regulatory credit.

-

The latest coverage change eliminated the fines of automobile producers that don’t meet emissions, eliminating this supply of earnings for the EV maker.

-

Analysts anticipate a major lower within the demand for credit, inflicting Tesla harm.

-

These ten shares can be shrouded in the next wave of millionaires ›

Buyers in Timing (Nasdaq: tsla) I confronted many adversity in 2025 as that they had at any time within the firm’s youth historical past. At present, they take care of gross sales and earnings which can be escalating, and a violent response to shoppers of Elon Musk’s political aspirations, and California tried to droop the license of Tesla service provider for 30 days, amongst different developments.

However there could also be a higher drawback in its fermentation, which is able to include a severe monetary impact on the electrical maker (EV).

One of many massive issues of Tesla Buyers is the sale of the corporate for organizational credit. These gross sales have at all times been a part of the story of EV Maker, and for a number of years, the corporate has achieved billions of {dollars} to promote organizational credit for its opponents.

Mainly, the USA authorities has developed the inducement system for car firms to fulfill environmental rules. I introduced the credit to automobile firms that complied with emissions and gave monetary penalties to those that didn’t meet the requirements.

What this implies for the automobile business firms that also promote automobiles that work with gasoline within the first place is that they’ve to purchase organizational credit from firms corresponding to Tesla, which solely promote EVS and don’t face any penalties. Nevertheless, the Republican Taxes and spending invoice earlier in July removes the monetary punishment of automobile producers which can be lower than emissions requirements. Which means that the inducement to purchase organizational credit from Tesla has disappeared, and the demand for its credit might dry a lot sooner than anticipated.

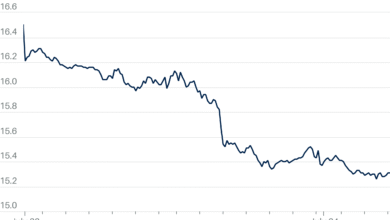

In keeping with analysts on the Monetary Companies Firm, William Blair, it’s anticipated that Tesla regulatory revenues for credit score will lower by 75 % in 2026 earlier than it utterly disappeared in 2027. So how vital this deal is?

The sale of Tesla has achieved organizational credit score alone 10.6 billion {dollars} since 2019, and traders might keep in mind that the EV maker would have misplaced cash in the course of the first quarter of this yr with out promoting these credit that improve the abstract. Saying that the corporate might not be current with out the supply of earnings throughout its early years, not exaggeration.

There’s a little silver lining to Tesla, as a result of the corporate has lengthy -term contracts with a few of its opponents to purchase these credit, and if the latter is honoring the contracts, as an alternative of making an attempt to get out early, the organizational broth practice might proceed for a bit longer.

2025-07-27 23:32:00