NY woman loans boyfriend $200K — then he lost it all in crypto and broke up with her. But Dave Ramsey has a plan for her

Think about your total life, and to save lots of onerous, simply see your accomplice blowing $ 200,000 of your cash on the encryption scheme. That is precisely what occurred in the good thing about one of many calles in New York Ramsey presentWho’s now celibate and leaves solely $ 95,000 for her title.

Lisa query: What now?

In 55 years, she now works as a servant in a classy restaurant and tries to know methods to rebuild its monetary future. Her greatest concern? She is not going to have sufficient to retire.

Lisa Dave instructed her that she gave her (now beforehand) her boyfriend for cash as a result of she thought she was for a very long time. They have been collectively for seven years, and whereas they by no means married, I believed the connection would proceed.

As an alternative, she ended the connection after she misplaced most of her life financial savings. He’s now doing small month-to-month funds, however she mentioned that this typically covers curiosity, and he or she just isn’t certain whether or not she’s going to by no means return the supervisor.

Lisa mentioned, “I’ll go away her within the fingers of God should you put together cash,” Lisa mentioned.

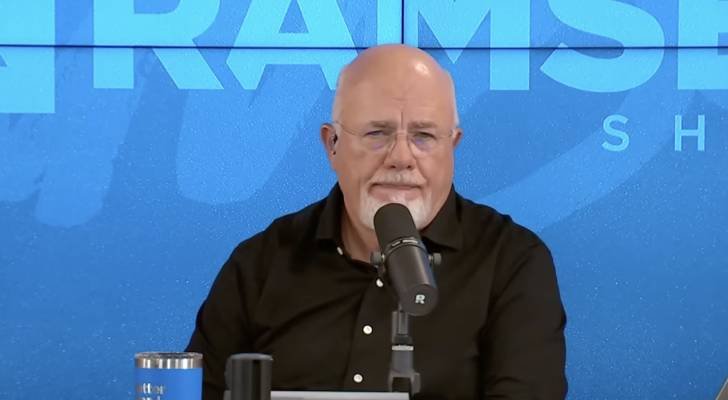

whereas Dave Ramsey He admitted the painful extent of the scenario, and shortly discovered a silver lining.

He mentioned: “Let’s solely show something of that.” “For those who name and say,” I’m 55 years outdated and I’ve $ 95,000, I’ll say, “Sure, you’ll be wonderful.”

Nonetheless, being wonderful comes with circumstances. Ramsey defined that Lisa’s financial savings alone is not going to switch it by way of retirement. You will want to proceed working, keep away from money owed and make investments correctly. The secret is not solely 95,000 {dollars}, however it has a plan for what it would do.

Ramsey defined a step -by -step funding technique:

-

Emergency Fund allotted: Maintain the bills of three to 6 months in a High -yield savings account. For her, that is about $ 15,000.

-

Make investments the remaining: Switch the remaining $ 80,000 to good funding funds in shares.

-

Use Roth Ira: Contributing yearly to make the most of tax -exempt progress.

-

Take a look at her office 401 (Okay): Though there isn’t any employer match, Ramzi steered contributing to a few of her revenue in 401 (Okay) as a result of IRAS has fewer annual contribution limits.

-

Make investments 15 % of its revenue: With an annual revenue of about $ 60,000, it ought to purpose to take a position about $ 9,000 a 12 months with their retirement accounts.

2025-07-29 12:30:00