Airbnb’s Cash Cow Can Thrive Despite Its Challenges

-

Airbnb faces organizational obstacles that the administration ought to attempt to overcome.

-

The corporate advantages from the big demographic winds.

-

Airbnb is a money movement machine and an incredible arrow for possession.

the Travel industry It’s a worthwhile however troublesome world. That is very true with regards to leasing within the brief time period. Mobility in native laws and worldwide enlargement with satisfying hundreds of hosts and much more company are among the arduous challenges they face Airbnb (Nasdaq: abnb)One of many leaders in area.

Its administration will increase its cooperation with the areas and enhances what’s seen as logical laws whereas sustaining its skill to work freely. Nevertheless, in some main markets, corresponding to Hawaii, New York and Paris, state governments and state governments have imposed strict restrictions on find out how to run brief -term rents. Many residence homeowners’ societies even have non -friendly guidelines for homeowners who wish to convert their property into brief -term rents. Nevertheless, the information shouldn’t be dangerous for Airbnb.

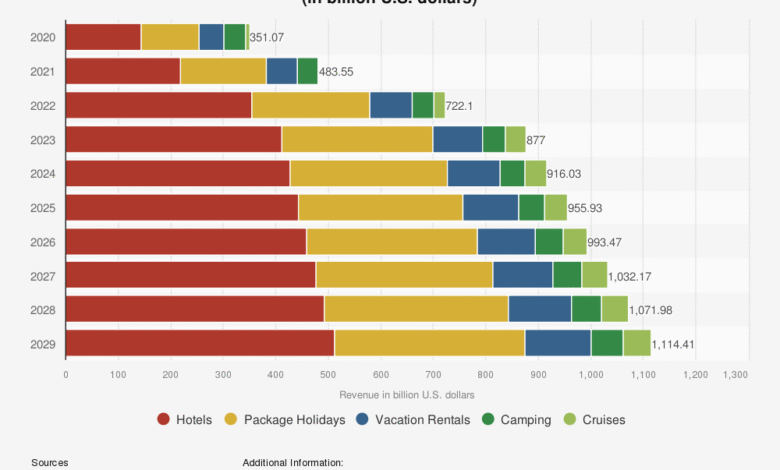

The market the place you’re employed is gigantic and continues to develop. There are additionally demographic winds, the place younger generations are usually attracted in direction of Airbnbs greater than their mother and father. Quick -term rents (trip rental on the graph under) is a big a part of the market that’s anticipated to exceed $ 1.1 trillion by 2029.

What does this imply for Airbnb? Criticism, and lots of of them.

Airbnb is only a software program platform in its essence. There’s additionally a customer support aspect. Nevertheless, corporations on this trade lack costly factories, gear and different main infrastructure that many different industries. Actual property and gear purchases are also known as CAPEX (brief to Capital expenses) And cut back the sum of money that the corporate can maintain. Free money movement is among the explanation why software program corporations, corresponding to Crowdstrike (Nasdaq: CRWD) and Baldir (Nasdaq: PLTR)Typically commerce in larger assessments of corporations in different industries.

For instance, Intel (Nasdaq: intc)A designer and clashes on semiconductors spent $ 5.2 billion on Capex in its final quarter, with 40 % of their revenues. Airbnb spent solely $ 14 million within the final quarter of Capex, lower than 1 % of its revenues. In the meantime, the free money movement – the remaining quantity elevated after working the bills and capital expenditures – elevated.

4.4 billion {dollars}, the above is 40 % of revenues throughout the identical interval. 40 % free money movement margin is an unbelievable and nicely -handed persona to shareholders.

2025-07-26 13:09:00