America is starting to eat Trump’s tariff TACO salad, UBS says

Inflation in america jumped to 2.7 % in June, which is a extreme improve in 5 months, in response to the newest shopper worth knowledge. UBS World Wealth Administration took a glance beneath the hood, the place she wrote in its month-to-month message, “It’s quiet … a bit calm.”

“Movie lovers will know this sense of rigidity when the hero takes to a brand new assumed space solely to seek out something there.” He writes that Taku merchants are ready for the following shoe, definitions at their highest ranges for the reason that Nineteen Thirties, and the independence of the Federal Reserve is threatened, as he writes. Nevertheless, international shares are on the highest normal ranges, worth shrinks, and tightening credit score variations.

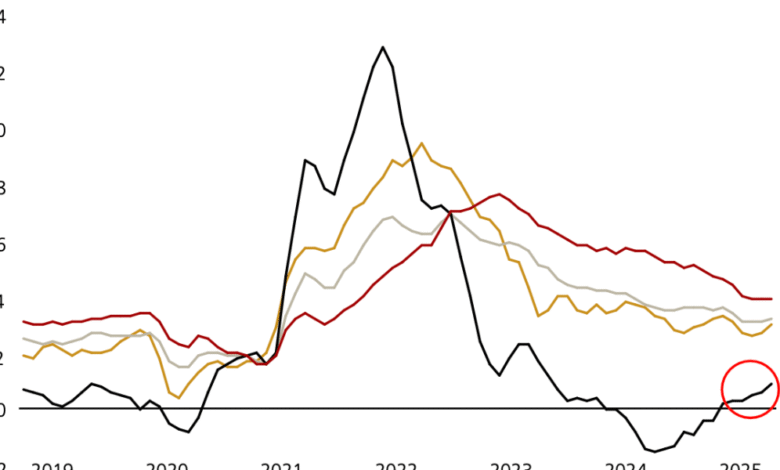

Haefle regarded beneath the primary inflation cowl for studying “fundamental items” in June, on the pretext that that is the place the impact of customs tariffs is detected, as a rise in June confirmed the very best stage of two years. Lots of the final acceleration displays the excessive costs in probably the most uncovered items to new tariffs – the furnishings involved with units, units, electronics, garments and video games. There is also a delay between when the customs tariff is announced, and when the importers store the goods, when the stores finally transfer these costs to shoppers, which means that this must increase in the coming months.

Global wealth management UBS

Everything is delayed

UBS global wealth management notes that data in the coming weeks and months will be a key to determining whether basic commodities are really rising, which reflects the effect of definitions. In fact, the industries that rely heavily on imports feel a pinch first. Retail sales decreased in categories such as electronics and home furnishings by 2 % and 1.1 %, respectively, once inflation is modified, with families starting to reduce spending in response to high prices. On the contrary, total retail sales volumes are still 0.4 % over the month, and consumer spending is still relatively flexible.

Who carries the burden?

The central question remains on the customs tariff: Who pays for them – the elderly, importers or consumers? Haefee warns that it is not clear how exporters, importers or consumers will divide economic costs. The division is likely to vary according to the industry, products and the situation in the market.

Some companies, such as General MotorsI’ve already reported a direct blow: Common Motors The second quarter profits It took a lack of $ 1.1 billion because of the tariffs, which led to a 32 % lower within the fundamental revenue. The auto industry company responds to a mix of prices, cost reduction, and supply chain modifications, but it warns that the ongoing tariff environment can increase margins or force high prices on buyers in the end. Through the broader business community, the company’s executive officials address the customs tariff for profit calls.

Haefee said that UBS will closely see retail sales, inflation and consumer spending, while listening to the comments in the continuous second quarter profit season about who will be “really” “Eat definitions“To reformulate President Donald Trump.

Politics compensation and federal reserve dilemmas

Some monetary displacement could also be on the way in which. A “lovely, lovely draft regulation”, which incorporates prolonged and new tax cuts – will help with the financing of customs tariff revenues – stimulate the economic system. However the quantity of those revenues isn’t clear.

The dangers of tendency in each instructions. If the customs tariff nourishes the bigger inflation mutation, it could decelerate, and the federal reserve could be compelled right into a troublesome political angle, and a steadiness between the soundness of costs in opposition to financial development. As an alternative, if corporations take in the prices of extra prices to maintain their share out there, earnings could improve, which will increase the impact on funding and employment markets.

Presently, the character of the late definitions signifies that its full impact has solely began to look beneath the floor of the deal with of the title. Economists and coverage makers will intently monitor fundamental inflation, retail gross sales, and company hikes.. The one certainty, apparently, is that the customs tariff is not a dialogue of the summary coverage: they began reaching the house – one worth at a time.

For this story, luck The bogus intelligence is used to assist with a preliminary draft. Verify an editor of the accuracy of the data earlier than publishing.

2025-07-25 18:28:00