BMO Capital Markets lead financial adviser in metals & mining M&A rankings for H1 2025

BMO Capital Markets leads the classes of mergers and acquisitions (M&A) for monetary advisors within the metallic and mining sector, each by means of the worth and measurement of the deal, for the primary half of 2025 (H1 2025), based on the most recent league desk printed by Globaldata, an information and evaluation firm.

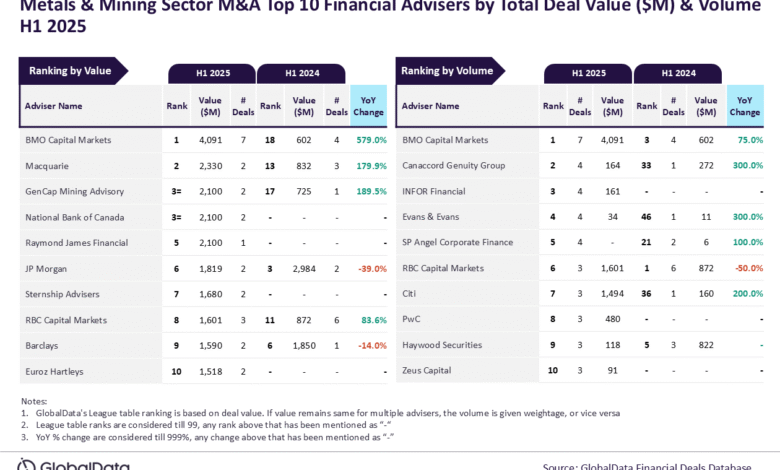

Based on the Globaldata Knowledge Knowledge Rule, BMO Capital Markets ranked first with recommendation in seven transactions, which amounted to $ 4.1 billion.

Within the worth class, Macquarie ranked second, and to advise offers price $ 2.3 billion.

The third place was a tie between the Guide GENCAP and the Canadian Nationwide Financial institution, with each recommendation on offers price $ 2.1 billion.

When it comes to the scale of the deal, Canaccord Genuity Group ranked second, after advising 4 offers.

This was adopted by a trilogy of corporations – Infor, Evans & Evans and SP Angel Company Finance – every additionally contributes to 4 offers.

“There was a yr on an annual foundation (YOY) within the whole measurement and worth of offers beneficial by BMO CAPITAL markets in H1 2025, in addition to their classifications by means of these requirements. Nevertheless, progress was extra clear when it comes to worth,” stated lead analyst at Globaldata Aurojyoti Bose.

“The BMO CAPITAL MARKETS classification was improved based on the scale of the third place to the very best place. On the similar time, its ranking has jumped from the eighteenth place to the upper place. It’s price noting that the corporate recorded greater than six occasions a bounce within the whole worth of offers beneficial in H1 2025.”

The league tables in Globaldata are primarily based on the precise time monitoring of hundreds of web pages for corporations, the consulting firm websites and different dependable sources accessible within the secondary discipline. A devoted staff of analysts displays all these sources to gather in -depth particulars for every deal, together with the names of the advisers.

To make sure extra information for information, the corporate as properly It seeks to offer deals One of many prime advisers.

2025-07-22 14:25:00