Beijing (AP) – China’s inventory market is rising on authorities guarantees Treating price wars That has harmed income and exacerbated world commerce tensions.

The prevailing networks are “combating the revolution”, and it displays the efforts made to cut back intense competitors and extreme vitality in industries akin to Solar panelsMetal vehicles, electrical energy.

With the rise in business obstacles akin to President Donald Trump A higher tariffComparatively Local demandThe producers decrease the costs, undermine their decrease traces and take some enterprise.

The product worth index, which measures the value of factories for his or her items, has decreased regular deflation. The lengthy -term subject was spared to the worldwide markets at a low worth Chinese exports The rising commerce friction with the primary business companions, together with america and Europe.

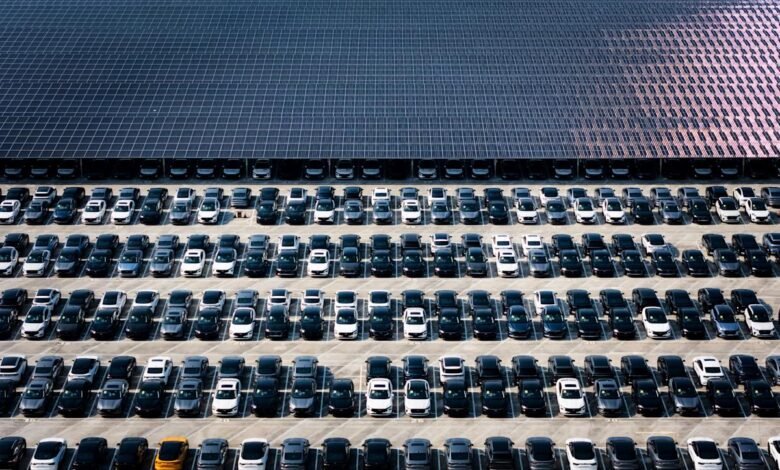

The photo voltaic plate glass makers agree to cut back manufacturing by 30 %

In a collection of latest statements, Chinese language authorities and business societies indicated that they’ve turn into critical in curbing competitors within the throat, often known as “concession or” Neijuan “in Chinese language.

The Business Affiliation mentioned that the ten finest glass makers for photo voltaic panels agreed on June 30 to shut the ovens and cut back manufacturing by 30 %. The federal government launched a automotive security inspection marketing campaign, coping with fears that automotive producers had been to beat high quality to cut back prices.

It’s unclear whether or not these efforts would succeed, however the feeling that China might lastly handle this continual downside was ample to excite in shares in some low strain sectors.

The shares of Liuzhou Iron & Metal Co. 10 % on Friday and greater than 70 % has risen since June 30. Changzhou Almaden Co.

On a wider scale, two of the containers circulated on the inventory trade within the photo voltaic and metal panels elevated by 10 %, which exceeds 3.2 % within the pioneering market index in China.

EV-Maker’s shares efficiency was blended, the place Li Auto and NIO recorded a share of two-number share whereas the BYD market has decreased.

Foreigners can’t purchase Chinese language shares immediately, however they’re able to spend money on about 2700 shares and 250 containers traded by means of Excination Hong Kong.

The federal government requires intense “unorganized” worth wars

The beneficial properties observe excessive -level governmental statements in opposition to non -disciplined worth wars. On June 29, the Folks’s Each day newspaper, which is the mouthpiece of the ruling Communist Occasion, managed a prolonged article on web page 1 on engagement, saying that they’re inconsistent with the social gathering’s objective of excessive -quality financial growth.

Chinese language chief Xi Jinping was weighing a closed financial assembly, calling for the very best competitors and incentives by native governments to draw manufacturing facility investments which are blamed for extreme funding within the affected industries.

The more durable dialog started with a deal with auto corporations in late Might, particularly on the wars of electrical automotive costs that began greater than three years in the past.

Analysts at Funding Financial institution UBS mentioned that the shift is nice information of the automotive business income and the shares of the corporate.

They wrote: “Though it’s troublesome to think about a sudden flip of the business from fierce competitors to organized unification, it’s already attainable to cease capturing within the close to -term struggle.”

Weak demand and extreme capability carry the wrestle to outlive

After BYD launched one other spherical of worth cuts on Might 23, some rivals and the primary affiliation of business and the federal government referred to as for a good and sustainable competitors.

The EV batteries, the Cement Affiliation and the key building corporations have issued echoes to finish the additional competitors.

The time period engagement, which signifies a spiral of inside and contraction, was initially utilized to college students and younger staff, who felt that they fell in meaningless competitors that didn’t provide wherever with weakening the labor market and stagnating wages in recent times.

On the stage of business, it has turn into the sectors which have a variety of corporations competing for a slice of the pie, which results in fierce worth cuts to attempt to acquire the market share.

A latest article within the Journal of the Communist Occasion Qiushi mentioned that the incompatibility between the productive means – the quantity of what the business can provide – and the precise demand for the product, displays extreme capabilities that power corporations to compete to outlive within the restricted market house.

Obstacles in reforming the issue

Some Chinese language industries, particularly metal and cement, have lengthy suffered extreme means. A authorities batch to reinforce inexperienced industries has strengthened related issues on this sector, together with photo voltaic panels, wind generators and electrical vehicles.

The flood of Chinese language exports results in extra business obstacles in Europe and america and in some rising markets akin to Mexico, Indonesia and India.

In the end, economists say industries must be unified by means of integration and chapter. However the course of will take a while. Among the many foremost impediment is the provinces governments that wish to defend native corporations and jobs.

Alicia Garcia Herro, chief economist within the Asia Pacific area on the Funding Financial institution in Natxis, mentioned the latest feedback issued by senior Chinese language financial officers indicated that they notice that one thing is required.

“How a lot is the process for phrases, I do not know,” she mentioned. “However I feel it’s a large downside for China.”

___

The Related Press Press Press.