Here’s Why We Think Cardinal Health (NYSE:CAH) Might Deserve Your Attention Today

It is not uncommon for a lot of buyers, particularly those that lack expertise, purchase shares in firms which have an excellent story even when these firms are a loss. However as Peter Lynch mentioned in One in Wall Road“Lengthy photographs by no means get fruits.” Loss making firms all the time races over time to achieve monetary sustainability, so buyers in these firms might face extra danger.

Opposite to all of this, many buyers choose to concentrate on firms similar to Cardinal Well being ((New York: Kah), Which not solely accommodates revenues, but additionally earnings. Though this doesn’t essentially communicate whether or not it’s dense of lower than its worth, the profitability of the work is adequate to make sure some estimate – particularly whether it is growing.

How shortly the cardinal well being grows in its earnings for the inventory?

Over the previous three years, Cardinal Well being has grown earnings for the arrow (EPS) at a powerful fee of comparatively low level, which led to a 3 -year share progress fee that doesn’t significantly point out the anticipated future efficiency. Thus, it is sensible to concentrate on extra fashionable progress charges, as an alternative. To some extent, the arrow’s profitability of Cardinal Well being launched from $ 2.51 to $ 6.52, in the course of the previous 12 months. A 160 % annual progress firm can not obtain.

The very best progress is a big indication that progress is sustainable, and it’s compelled to extend earnings earlier than the curiosity of curiosity and taxes (EBIT). It’s a good way for the corporate to keep up a aggressive benefit out there. It was a 12 months of stability for the well being of Cardinal, as all the income margins and worldwide aim remained flat over the previous 12 months. This isn’t dangerous, but it surely doesn’t point out steady steady progress both.

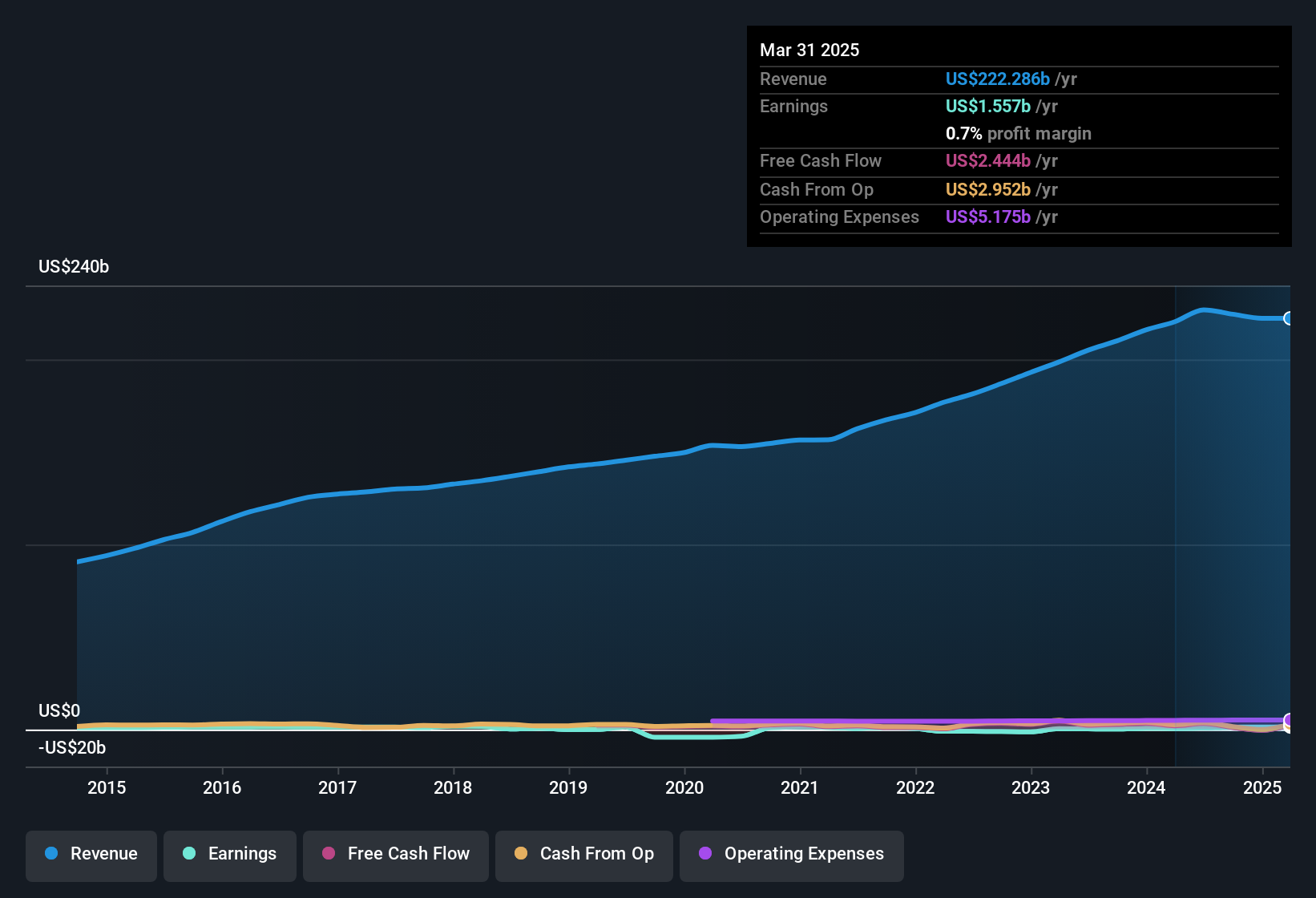

Within the graph under, you possibly can see how the corporate has grown earnings and revenues, over time. For high-quality particulars, click on on the picture.

Check our latest analysis of cardinal health

Thankfully, we’ve entry to analysts’ expectations from Cardinal Well being future Earnings. You are able to do your personal expectations with out trying, or you possibly can Take a peek at what professionals expect.

Are the alignment of these accustomed to Cardinal well being with all shareholders?

As a result of measurement of the cardinal well being, we don’t anticipate the knowledgeable to hold a big share of the corporate. However we really feel snug with the truth that they’re buyers within the firm. In actual fact, they maintain $ 43 million of their shares. This nice funding ought to assist pay an extended -term worth at work. Though its possession is simply 0.1 %, that is nonetheless a big quantity at stake to encourage the corporate to keep up a technique that gives worth for shareholders.

Do you have to add Cardinal’s well being to your monitoring menu?

Cardinal Well being’s earnings have been launched in an exquisite method. Definitely, the expansion of the arrow’s profitability is the acquisition of consideration, and the possession of the big individuals doesn’t work besides to extend our curiosity. Hope, after all, is that sturdy progress is a basic enchancment in enterprise economics. Primarily based on the entire variety of components, we undoubtedly imagine that it’s price watching the Cardinal’s well being carefully. Earlier than you are taking the following step, it’s essential to understand it about 1 Cardinal Health Warning sign We found.

There may be all the time the potential for doing an excellent job in shopping for shares no Elevated earnings and no Ask the insiders to purchase shares. However for individuals who contemplate these vital requirements, we encourage you to test the businesses that Do You may have these options. You may attain A list of companies that have shown growth supported by important interior property.

Please be aware the inner transactions mentioned on this article point out the transactions that may be reported within the related judicial jurisdiction.

new: Amnesty Worldwide Screener & Alerts

The brand new inventory sorting of synthetic intelligence wipes the market daily to disclose alternatives.

• Distribution distributions (3 %+ return)

• Small hats are lower than their worth with the inside buy

• Excessive -growth know-how firms and synthetic intelligence firms

Or construct your from greater than 50 requirements.

Do you will have reactions about this text? Nervousness about content material? Connect in contact With us immediately. As an alternative, the Electronic mail Edit (AT) Simplywallst.com.

This text is solely a public road in nature. We offer feedback primarily based on historic information and analysts’ expectations solely utilizing an unbiased methodology, and our articles don’t intention to be monetary recommendation. Don’t represent a suggestion to purchase or promote any shares, and don’t take note of your targets, or your monetary state of affairs. We intention to usher in the long run evaluation pushed by primary information. Notice that our evaluation might not work within the newest advertisements of the corporate delicate to costs or particular supplies. The wall merely doesn’t have a place in any talked about shares.

2025-07-28 10:51:00