(Bloomberg)-The Federal Reserve Chairman Jerome Powell and his colleagues might be taken to the Central Financial institution’s Board Corridor on Tuesday to commerce rates of interest at a time of large political pressures, superior commerce coverage, and financial automobiles.

Most of them learn from Bloomberg

In a uncommon incidence, coverage makers will make the federal government to difficulty stories on gross home product, employment and favourite worth requirements of the Federal Reserve. Federal reserve officers meet on Tuesday and Wednesday, and they’re broadly anticipated to maintain the costs not change once more.

The predictors anticipate that the heavy dose of knowledge will present the financial exercise that was recovered within the second quarter, attributable to a big extent to extreme narrowing of the commerce deficit, whereas the expansion of jobs was ran in July. The third Marquee report could present the essential inflation that was taken a bit in June of a month earlier.

Whereas the federal government’s pre-estimated estimate of the GDP of the quarter will seem yearly by 2.4 %-after the volatility of the economic system by 0.5 % in January to March-a report could solely reveal the standard demand for residence and funding in enterprise.

The common common in a Bloomberg investigative research requires 1.5 % revenue in client spending to have a good time the weakest consecutive quarters for the reason that starting of the epidemic in early 2020. The delicate housing market was additionally weighing exercise within the second quarter.

On the finish of the week, the JOBS report is predicted to look in July that corporations have turn out to be extra intense to make use of them. The employment is prone to be supervised after a rise in June, which was bolstered by a bounce in instructional wage statements, whereas the unemployment fee is seen as much as 4.2 %.

The wage statements are anticipated to rise by 100,000 after the smallest progress in eight months. Throughout the first half of the yr, the frequency of employment fell by corporations in comparison with the typical of 2024. The widening vary of job progress was additionally comparatively slim. Separate numbers are anticipated to indicate a lower in job alternatives in June.

Just a few federal reserve officers have begun to lift issues about what they see as a fragile labor market, together with two who stated they see a benefit in contemplating decreasing costs now. The strain additionally escalates from exterior the assembly room. President Donald Trump was specific about his want to see Powell and Co. for a lower in borrowing prices for shoppers and firms.

What Bloomberg Financial says:

“We imagine that the slowdown led by the patron poses a hazard to expectations. Whereas retail gross sales in June gained expectations, that are prone to have a mirrored image to extend costs that rely on customs tariffs in some commodity classes. Ultimately, the labor market-which we anticipate to proceed to weaken this year-will decide the course of consumption.”

Anann Wong, Stuart Paul, Eliza Winger, Estelle ou & Chris G. Collins, Economists. For full evaluation, click on right here

The president was typically punished for transferring very slowly, whereas on the similar time geared toward overseeing the excesses of building prices associated to renewing the headquarters of the Federal Reserve Constructing in Washington.

Powell and different central bankers emphasised the necessity for persistence that the Trump administration tariff threat re -accelerating inflation. So far this yr, when a wide range of imports has been imposed on imports, worth pressures had been modest.

On Friday, the federal government’s earnings and private spending report is predicted to look, on Friday, the popular fundamental inflation scale barely for one month, indicating that the customs tariff is progressively transferred to shoppers.

Along with the North, Canada Financial institution can be scheduled to maintain, whereas sustaining borrowing prices with 2.75 % to carry a 3rd consecutive assembly amid commerce uncertainty, sticky fundamental inflation, and the economic system that appears to cope with the tariff higher than many economists anticipated. Officers will difficulty a report on financial coverage, nevertheless it has not but been recognized whether or not they would return to level expectations or difficulty a number of situations, as they did in April amid a risky American commerce coverage.

It’s anticipated that the GDP information primarily based on the business and the estimation of flash for June will point out a shrinkage within the second quarter. Prime Minister Mark Carney is urgent for a business cope with Trump by August 1, however he and the leaders of the nation’s provinces lowered expectations, saying that they’re focusing above all on acquiring a very good settlement.

On the world degree, Trump’s deadline is occupied on Friday, with many economies – together with the European Union, South Korea and Switzerland – are nonetheless hoping to acquire commerce agreements.

European Fee President Ursula von der Lin, US President in Scotland, will meet on Sunday afternoon in an try to safe an settlement. European Union officers have repeatedly warned that the deal is in the end with Trump, making prediction of the tip consequence.

In the meantime, US Treasury Secretary Scott Besent and Chinese language Deputy Prime Minister had been scheduled to start out beginning on Monday in Stockholm. The 2 international locations are anticipated to increase the truce of customs tariffs for an additional three months.

Elsewhere, additionally it is doable that the central bankers in Japan and Brazil will keep charges unchanged, whereas the reductions are anticipated in South Africa, Chile, Ghana, Pakistan and Colombia. Traders may even see the expectations of the brand new Worldwide Financial Fund, the readings of worldwide buying administration indicators, a barrage of GDP and inflation information in Europe.

Click on right here for what occurred final week, and beneath is our cowl for what is going to occur within the world economic system.

Asia

The spotlight of the central financial institution in Asia comes on Thursday, the place the Financial institution of Japan is predicted to maintain its normal worth at 0.5 %. The response of the ruler Kazuo Uda to the American business deal might be to focus after his deputy stated that the settlement has strengthened the opportunity of fulfilling financial expectations – a significant situation for elevating one other fee.

A lot of information will replicate the Trump marketing campaign’s identification marketing campaign. Commerce numbers are from the Philippines, Hong Kong, Sri Lanka, Thailand, South Korea and Indonesia, whereas the numbers of buying managers are manufactured all through the area.

China will get two teams of PMI information in July on the finish of the week, with consideration whether or not the official scale might be larger for the third month and the S& P World index within the enlargement space can stay. Industrial income – revealed on Sunday – revealed a second consecutive month of declines, because the authorities had been appointed to accentuate their management to kind extreme competitors that decreases costs and doubles ache from the American definitions.

Among the many statistics issued by the administrators of purchases are Indonesia, South Korea, Malaysia, the Philippines, Thailand, Taiwan and Vietnam, all on Friday.

In the meantime, Australia will get the second -quarter information anticipated to indicate client enlargement TAD, which may give the Financial institution Room to renew the worth chopping cycle when the subsequent coverage is set on August 12.

The central financial institution in Pakistan could cut back costs on Wednesday, and two days earlier than the nation – Indonesia – obtained new inflation readings.

Europe, the Center East and Africa

Directing and inflation information all through Europe takes the middle of the lead. Economists anticipate an opinion ballot in Bloomberg to indicate numbers on Wednesday the gross home product within the euro space within the three months to June, after increasing 0.6 % within the first quarter. This efficiency was raised by the entrance loading in commerce earlier than Trump’s anticipated announcement of worldwide import duties.

Among the many largest blocks of the mass, Germany is predicted to see the worst efficiency, with a lower in manufacturing by 0.1 % of the earlier quarter. Spain is predicted to develop 0.6 %, with France and Italy’s enlargement a bit. The smaller economies unfold their numbers all through the week, with Eire – typically a land card for the bloc’s economic system – issues begin on Monday.

In the meantime, on Friday, the European Central Financial institution is to substantiate the arrogance of the European Central Financial institution that it has been managed. Shopper costs are anticipated to extend by 1.9 % in July, lower than 2 % than the earlier month and fewer than the central financial institution’s objective. Maybe the essential inflation scale remained fastened, by 2.3 %.

With most of Europe in holidays, just one speaker of the European Central Financial institution had a scheduled look – Spain Jose Luis Eskiva, on Monday – whereas the outcomes of the month-to-month survey of the Central Financial institution of inflation for shoppers are due after a day, and the wages monitoring comes on Wednesday.

The Financial institution of England goes to a quiet interval earlier than its choice on August 7, with financial releases on the UK’s agenda primarily linked to housing.

Worth selections all through Africa are scheduled:

-

The acute slowdown in inflation will witness officers in Ghana, the lower in borrowing prices by 250 foundation factors to 25.5 % on Wednesday. Its actual common is the very best since 2005 no less than, offering room for the central financial institution to supply the biggest lower in additional than twenty years.

-

South Africa is scheduled to increase its longest dilution course since 2019, when inflation is predicted to stay benign. Economists surveyed by Bloomberg anticipate the central financial institution to scale back 25 foundation factors to 7 %.

-

On the identical day, the coverage makers in Malawi are getting ready to depart their important fee unchanged by 26 % attributable to overseas alternate restrictions and protracted worth pressures.

-

The technical recession in Mozambique might be persuaded to decide on extra mitigation on Thursday to stimulate the economic system. It has lowered 625 foundation factors since January 2024.

-

Eswatini, whose foreign money is linked to Rand, is prone to cut back it in 1 / 4 of a degree on Friday, to six.5 %.

latin america

On Tuesday, the Central Financial institution of Chile is probably going to supply its first first -class discount for 2025, and selected to scale back 1 / 4 of a degree to 4.75 %.

Shopper costs are cooled final month greater than anticipated, and inflation slows down once more consistent with the central financial institution’s expectations, which re -read the deal with to a 3 % objective in 2026.

The info of the second quarter of Mexico, which was revealed on Wednesday, should present the 2nd economic system in Latin America, which publishes quarterly and yr enlargement on an annual foundation amid clouds from Trump’s buying and selling and tariff insurance policies.

Most analysts see the second half of the yr a higher problem.

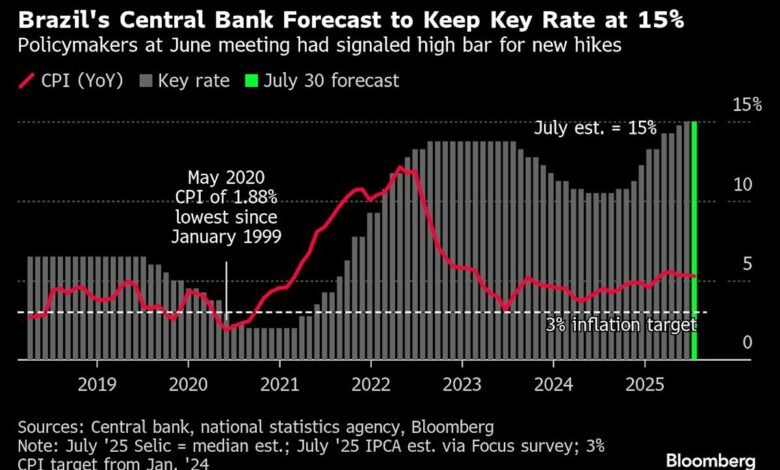

Within the choice of the second central financial institution worth within the area, it’s broadly anticipated that the Banco Central Do Brasil will draw a line by seven -part tightening marketing campaign, 450 factors, and keep the primary SELIC fee by 15 %.

Current inflation publications and expectations near the length started to say no, however coverage makers final month indicated that borrowing prices will most definitely stay fastened for a very long time.

In Colombia, the primary inflation extends over the higher a part of the Banrep tolerance vary and raised fundamental readings raised, however policymakers could have seen sufficient cooling in client worth information in June to justify 1 / 4 -point discount, to 9 %.

On Friday, Peru begins client worth stories to focus on massive inflation within the area. The early consensus between economists is that the annual studying in July will come close to the printing of 1.69 % in June.

-With the assistance of Alexander Weber, Andrew Atkinson, Brian Fowler, Eric Hirtburg, Mark Evans, Monic Fanik, Piotr Scolimiuski and Robert Jameson.

(Updates with the truce of the US of Chinese language commerce within the sixteenth paragraph)

Most of them learn from Bloomberg Enterprise Week

© 2025 Bloomberg LP