Texas Stock Exchange is poised to improve our financial system

Finance performs an essential function within the financial prosperity of the USA. The monetary system locations the capital within the fingers of entrepreneurs and firms higher than utilizing it. The important thing to that is the inventory trade works properly. Exchanges additionally add a worth that isn’t guided by accumulating investor opinions to costs that work as alerts about the way forward for firms, industries and macroeconomics.

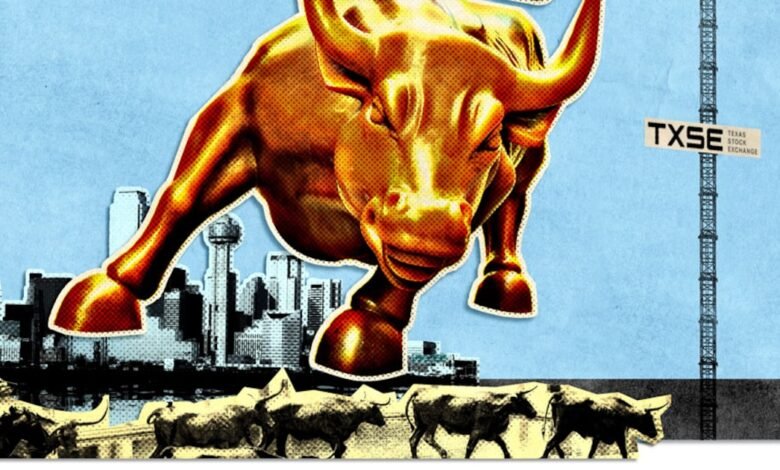

Whereas the USA has the most effective inventory exchanges on the planet, it’s deliberate Enter the Texas Exchange (Tse) It prepares to enhance our monetary system essentially, and thus our capability to develop and prosper. These enhancements will come up from growing competitors, decreased prices, diversifying political dangers and larger participation of the investor.

Good time for such a new participant. As a professor, I’ve lengthy glorified the virtues of each the New York Inventory Change and Nasdak. However their success has created a dysfunction, and the “market market” have to be extra aggressive. One of many new contributors, who’re appointed to good costs, will press innovation, for concern that they’ll lose the menus or buying and selling quantity. One can’t predict all aggressive responses, however financial rules point out that there will probably be benefits for each inventory marketing campaign, who present capital and firms, which search to lift them on the lowest potential price.

A number of the prices confronted by the itemizing firms are clear – together with organizational burdens and devoted disclosure. Some are extra correct and extra correct, however not much less lifelike. Firms search the flexibility to prepare their management and processes, and a predictive area of play. If the inventory trade set the required panel constructions or authorized safety, the councils of firms and executives could face choices with out certainty and deviations.

Along with the innate worth of competitors, geography is anxious as a result of it’s linked to each political positions in the direction of enterprise and the volatility of politics. It isn’t a coincidence that “T” in TSE represents a state of affairs by which firms are low specific prices and extra freedom in autonomy beneath a extra predictable group. Tse is the latest positive in the business environment This prompted firms to maneuver to Texas in giant numbers.

Texas growth as a financial center It additionally diversifies the political dangers built-in right into a monetary system that relies upon vastly on New York. Don’t look additional than the preliminary results of the final New York Metropolis mayor to seek out out issues in regards to the dramatic coverage fluctuations and its impression on employment and the flexibility to draw distinctive abilities.

Growing competitors is just not solely good for listed firms, but in addition helps buyers. TSE has given precedence standards to incorporate firms that can assist merchants confidence and confidence, which can improve participation in the long run. A brand new place will result in a lower in buying and selling prices, larger efforts to find data associated to worth and enhance market effectivity.

Dallas is the right web site to make the most of an essential and deep group of buyers. The superior monetary gamers within the metropolis and the nation – together with the household establishments and places of work that give precedence to non-public investments in recent times – will undoubtedly flip a few of their consideration to firms that select to incorporate them on Tse.

Including Tse helps us all – not solely in Dallas however all around the nation. We’ve seen extra firms that select to stay non-public, and Tse stand prepared to assist switch the price and advantages to be circulated publicly in the direction of the place it was. This shift will scale back the price of capital, encourage firms’ innovation, diversify geographical dangers, and assist extra buyers reap lengthy -term rewards for belief -reliable inventory market.

Jay C. Hartzelle holds the eleventh president of SMU. He’s a acknowledged college chief on the nationwide degree and has a deep expertise in enterprise schooling and analysis that focuses on financing firms and company governance and actual property.

2025-07-17 06:30:00