The markets are behaving as if Europe has pulled the wool over Trump’s eyes

European shares elevated at this time by 0.93 %, and the Stoxx EUROPE 600 is approaching once more. (Quite the opposite, the S&P futures elevated solely by 0.28 % this morning.) On condition that america slapped Europe by 15 % on all its exports to America, why traders in Europe are very optimistic?

One of many theories is that they’re buying and selling as if one of many two situations would flip to be appropriate:

- The brand new European Union deal, like its Japanese counterpart, which is generally made up of issues that may by no means happen or have occurred anyway, and thus change barely.

- The US Supreme Courtroom will rule that Trump has no energy to barter the definitions by itself Under the International Economic Forces LawAnd that every one his empty offers shall be introduced, and the tariff ranges near zero shall be resettled.

This is able to clarify why, this morning, Goldman Sachs conveyed his appreciation for the GDP of the European Union Up 0.1 %, after the deal, in keeping with a memo of Sahar Islam and Ayushi Mishra.

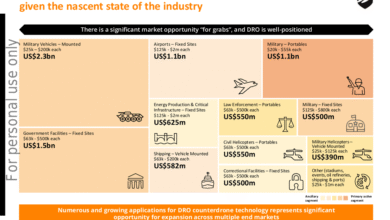

Analysts this morning means that European Union officers have pulled the wool on Trump’s eyes in negotiations. The deal consists of $ 750 billion of “strategic purchases”, $ 600 billion in non-public funding, and “big portions” of navy gear purchases. However there may be close to the consensus in Wall Avenue that personal funding will happen anyway within the context of regular work.

“600 billion {dollars} symbolize the present funding plans, not a brand new funding,” Mark Wall and his group in Deutsche Bank He wrote this morning.

“Pie within the sky”

The Monetary Occasions reported this morning that Europe’s “promise” to buying vitality 750 billion {dollars} from america can’t be already fulfilled as a result of the European gas market is managed by non-public firms, not its governments. “Even when Europe desires to extend its imports, I have no idea the mechanism that the European Union goes to those firms and asks them to purchase extra American vitality,” Matt Smith, EXC in KPLER vitality consulting. FT said. It was known as “a pie within the sky.”

The European Union authorities doesn’t have the power to compel non-public firms to purchase American oil, the vitality value is declining, and the lengthy -term pattern in Europe is to step by step do away with fossil fuels in favor of renewable vitality sources. “The European demand for fuel is gentle and the lower in vitality costs. Nevertheless, non-public firms don’t stipulate that they contract with vitality imports,” FT said. “We prefer it or not, in Europe the windmills win.”

Navy purchases should not shocking, provided that Russia is waging the battle on its japanese wing. Europe wants all of the weapons you will get. NATO shall be comfortable to purchase from america

VOS decisions towards Trump

After that, ready within the wings is the most important attainable shock for all international shares for them: VOS decisions towards Trump. This challenge was offered by a gaggle of offended American firms that their payments are rising on account of definitions. They argue that Trump’s assertion of the nationwide emergency state of affairs beneath the Financial Forces Legislation within the 1977 worldwide emergency circumstances shouldn’t be legitimate to conclude industrial offers with out the approval of Congress. (Congress is the standard physique that approves industrial offers)

“If IEEPA shouldn’t be utilized, then the standing of business offers can also be clear,” Jahangir Aziz and Bruce Kasman from JPMorgan prospects this morning.

The Supreme Courtroom is filled with Trump’s non-public decisions, in fact, in order that he can count on a sympathetic session. Nevertheless, an enormous leap for the judges shall be to agree that the routine commerce deficit A national emergency is formed.

In the event that they in the end declare unlawful definitions, count on shares to leap.

Here’s a snapshot of the process earlier than the opening bell in New York:

- S & P 500 futures contracts It elevated by 0.28 % this morning, after the index closed by 0.018 % on Monday, reaching the very best new stage ever at 6389.77.

- Stoxx Europe 600 The rise of 0.93 % was in early buying and selling.

- FTSE 100 in the UK 0.73 % elevated in early buying and selling.

- Japan Nikki 225 1.10 % decreased.

- Chinese language CSI 300 Index It was 0.39 %.

- South Korea Cuban It was 0.66 %.

- Elegant India 50 It was 0.50 %.

- Bitcoin He holds greater than 118 thousand {dollars}.

2025-07-29 11:36:00