Securities and Inventory Alternate Committee The latest guidance The door hits overtly open to the move of cash uncovered to encrypted currencies equivalent to Solanaand Ripple’s XRPEven perhaps Mimikoin, President Donald Trump, the specialists instructed luck.

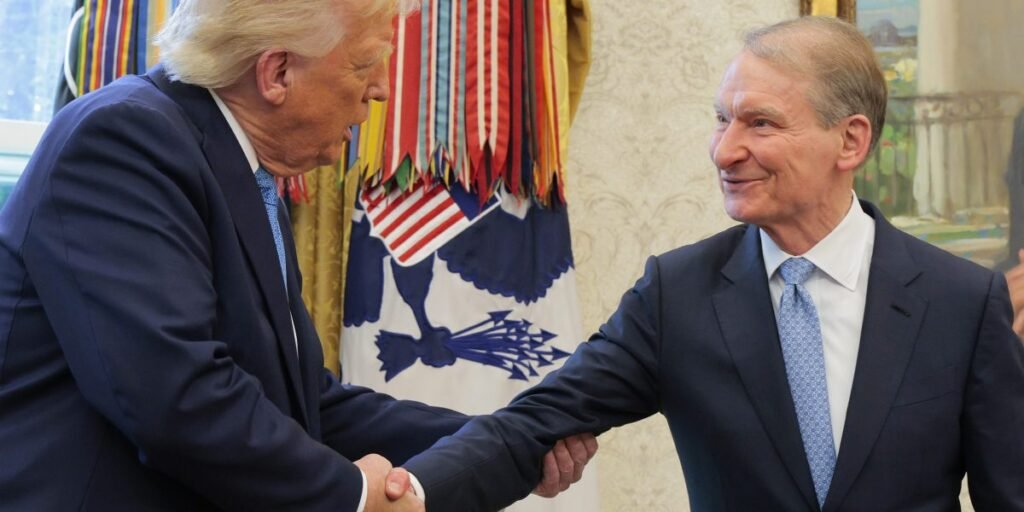

The brand new Solt Speaker of Trump Paul Atines is one step from that vision From the decentralized financing motion after SEC has issued new pointers this month, giving asset managers extra particulars about acquiring merchandise traded on the inventory alternate associated to encrypted currencies accredited by the committee. Consultants instructed that this step requires an anticipated set of cash uncovered to encrypted currencies equivalent to Solana, Ripple’s XRP, and even perhaps Memecoin Trump. luck.

And Andy Martinez, CEO of Crypto Insights, mentioned, mentioned luck. Digital asset knowledge supplier connects the establishments to finance managers. “We count on to see extra of the subsequent capital to funding merchandise in encryption,” he mentioned.

Consultants instructed specialists who instructed SEC to SEC, probably the most pleasant Republican buddy. luck. Additionally it is a exceptional exit from the ancestor of Atkins, former head of the Securities Council and Inventory Alternate Gary Ginsler, who confronted a A barrage of criticism To cope with the encryption business.

In January, SEC introduced a brand new The encryption workplace It goals to develop an organizational framework for encryption belongings, simply days after Trump foot Memecoin, $ Trump, a kind of cryptocurrency is normally related to a joke or path on-line. Now, with the newest directives, asset administration firms have a clearer image on how you can adapt their Crypto ETF functions to comply with it, and invite a brand new move of functions.

In 2024, the Supreme Training Council consent The primary ETF encryption, permitting 11 firms to launch the funding funds circulating in Bitcoin that comply with the present market worth, or quick worth, widespread encrypted currencies. Greenight made it doable for buyers to be bitcoin by means of the autos traded on the inventory market with out the necessity to purchase them immediately. second consent Funding funds circulating for the second within the in style cryptocurrency, ethereum, later that yr.

Now, Martinez says that SEC has a “very massive accumulation” of funding funds circulating within the funding funds circulating in regards to the numerous encryption belongings which might be ready for approval and anticipating the listing to be extended solely after the brand new directive, though it’s anticipated that the approval course of shall be accelerated.

“It’s a fully lengthy course of, and with such guides, a part of the initiative is to cut back that point to begin considerably,” mentioned Martinez.

Though the directives will not be an official group of guidelines, Aniket Ullal, president of ETF Analysis & Analytics in CFRA Analysis, mentioned it displays the present SEC administration objective is to be extra lively in relation to regulating encryption. Gensler sought to forestall the approval of the funding funds circulating in Bitcoin, earlier than a Court decision The way in which to launch them.

“With the earlier SEC, led by Gensler, there was an opinion that the Supreme Training Council was extra interacting with encryption,” luck. “There are lots of functions. I feel there shall be lots of launch operations and shall be extra frequent and extra diversified when it comes to coin kind.”

As of July 7, Olaal mentioned there are 76 funds of funding funds circulating in the US that comply with the encryption spot and future costs. Bitcoin and Eter merchandise are the overwhelming majority of the traded funding funds. First, you count on to see extra topical merchandise from Solana and Ripple in addition to different metallic currencies which might be supplied to the traded funding containers.

“At present, now we have solely 4 cash, specifically Bitcoin, Eter, Ripple, and Solana, so we might even see different varieties of cash, together with Trump.”

New directives name for extra transparency

SEC pointers require asset managers to put in writing in easy English “to explain the encryption belongings and their buying and selling platform, giving asset managers chargeable for revealing a doable battle of pursuits.

Olal mentioned the disclosure necessities are just like any belongings registered below SEC, however with the “particular” encryption particulars required because of many nuances that come from the unconventional origin.

“Concilious, the thought of detection and transparency can also be current within the space of shares and bonds,” Olal mentioned. “Right here, issues will not be unified.”

Nonetheless, Win Molino, CEO of Crypto Insights Group mentioned. luck The necessities of the most important disclosure could also be a bonus Akbar, conventional asset managers who need to enter the encryption house might face the comparatively smaller asset managers who deal completely with Crypto, might face a larger drawback in adapting to the brand new compliance system shortly.

“So what this implies is that these firms could possibly present customary ranges of business from the transparency and disclosure that will not be used on them,” Molino.

2025-07-10 11:27:00